Prime minister Rutte misleads Wall Street Journal about Dutch debt problems

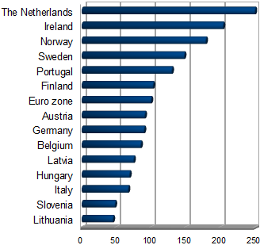

Last week the Wall Street Journal published an excellent article by Matthew Dalton titled Mortgage Burden Looms Over Dutch. Us Dutch have an average debt of 2.5 times our yearly income, which makes us the heaviest lenders of Europe.

We got into this position because of the way we structure our mortgages. We borrow heavily, then let that debt stand for decades. Interest is deductible from our income tax.

Asked of Prime Minister Mark Rutte (VVD party) whether this is a problem he told Wall Street Journal:

“It’s not a big issue…if you look at the whole picture,” he said, noting that the Dutch have saved as much in their pension funds as they have in mortgage debt—”and we have huge private savings.”

Financial news website Z24 sorta-kinda calls Rutte out on that. “Staat genoteerd”, (duly noted) writes Jeroen de Boer, i.e. “whatever“. What the Wall Street Journal doesn’t know, and what somebody who is such a great fan of “the whole picture” should have told them, is that mortgage interest deductions are one of the core political wedge issues in the Netherlands. Both Rutte’s party VVD and their coalition partner CDA have told their constituencies time and again that they will never abandon the tax deduction.

That this is a no-win situation should be clear to any neutral observer. As Z24 points out (a commenter uses a delightful Dutch expression, ‘until the shore will turn the ship’) mortage interest deductions are somewhat defensible as long as house prices keep rising. The money borrowers save can be put into savings accounts and life insurances, only to be released when the tax deduction term runs out. House owners can then pay off their debt. They can even make a little money by selling the house, and use the money to move into a bigger house that they otherwise would not have been able to afford.

Such a way of borrowing is a gamble (you might lose the income with which to make those savings), but not typically a large one, and one that you can insure against.

The problem is of course that this method is not sustainable when house prices start dropping, which is exactly what has been happening for the past few years. Z24 adds:

The group of 25 to 35-year-old house owners owned 30 to 40 percent more than they owed in the mid-1990s. Since 2009 they owe more than they own. That is to say, the values of their mortgages is higher than the values of their houses. Super heavy mortgages (where people borrow more than is needed to purchase a house) and interest only mortgages have made this group vulnerable.

The result is that the Dutch are engaging in a folly that is not unlike the one the people of Iceland engaged in not so long ago.

(There are other problems with mortgage interest deductions that would take too long to explain fully in this posting, but in short, they dampen spending. They keep mortgages artificially high, and also house prices. They are typically paid for by the poor, as the poor must rent—they don’t pay enough deductions for taxes— and rents follow house prices.)

[…] to this toxic mix the fact that politicians don’t want to be seen touching interest deductions and you have the recipe for an unhealthy housing market for years to […]