Bitcoin on the Dutch income tax form

It was only last year that finance minister Dijsselbloem told Dutch parliament how he was going to treat Bitcoin and already the virtual currency has found its way into the income tax forms.

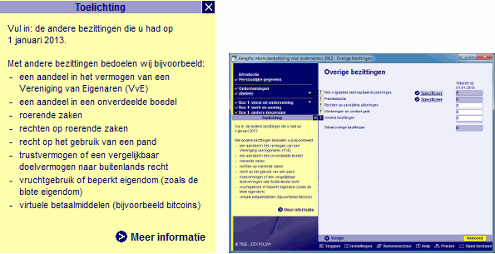

What you see here is a screenshot of the form I used last weekend to report my income. There is a box for “other possessions” which includes goods, trust funds, inheritances that have yet to be divided and so on. The last line of the yellow explanatory box (enlarged in the illustration) says “virtual mediums of payment (for instance bitcoins)”. Unfortunately the “more information” link doesn’t help you find out how to value your Bitcoins. I am sure that is something left for the likes of Kluwer and Elsevier with their tax guides and tax almanacs.

Since the income tax law of 2001, Dutch income tax is calculated over the money you make from work (box 1), from investments (box 2) and from property minus debt (box 3).

(Thanks to commenter Corné at Iusmentis for pointing this out)

Da’s heel simpel: als je aangifte doet over 2013, geldt de koers van 1 januari 2013. Net zoals je bij spaargeld je saldo van 1 januari 2013 moet invullen.

Dat is eerlijk gezegd ook wat ik verwachtte.