Why would you want to ask a court whether an Apple iPad is a phone or a general computer? Well, if computers given as a Christmas bonus are considered income and phones are not, you might have an incentive, especially if the back taxes amount to 323,687 euro.

Why would you want to ask a court whether an Apple iPad is a phone or a general computer? Well, if computers given as a Christmas bonus are considered income and phones are not, you might have an incentive, especially if the back taxes amount to 323,687 euro.

Broadcaster RTL Nederland gave 664 of its employees an iPad in 2010, including a Vodafone 3G subscription. The law says that something supplied by one’s employer does not count as income if this something is intended “to prevent costs, expenses or depreciations needed for a correct execution of one’s employment”, Arnoud Engelfriet reports.

The law also prescribes categories of devices that are applicable, including “phones, Internet and such communication devices, but not computers, nor similar devices or peripherals”.

RTL Nederland sued the Dutch tax office and the question before the court became whether these iPads were mainly computers or mainly communication devices. The court ruled on 30 November that “considering the format of the iPad (the version the claimants provided has a 9.7 inch screen diagonal) verbal communication should not be seen as the central function of the iPad.”

RTL Nederland will appeal the decision. “We are a media company,” a spokesperson told Webwereld. “We work with those iPads, they are part of our daily business.”

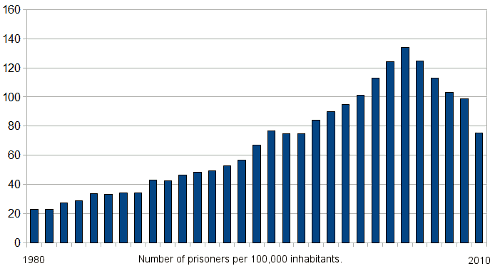

In 2010 there were 75 prisoners per 100,000 inhabitants in the Netherlands.

In 2010 there were 75 prisoners per 100,000 inhabitants in the Netherlands.

A tiny victory for real globalization. After years of pressure by Dutch consumer watchdog Consumentenbond, American electronics manufacturer Apple has finally adapted its warranty for the Netherlands to make clear that is bound by Dutch law.

A tiny victory for real globalization. After years of pressure by Dutch consumer watchdog Consumentenbond, American electronics manufacturer Apple has finally adapted its warranty for the Netherlands to make clear that is bound by Dutch law.  Engelfriet

Engelfriet

It took a couple of lawsuits to put their prospective gatekeepers into place, but both the Dutch postal code data and the Dutch road map data have been set free.

It took a couple of lawsuits to put their prospective gatekeepers into place, but both the Dutch postal code data and the Dutch road map data have been set free. There seems to be a lot of

There seems to be a lot of  Wedged between the Dutch republic and the Dutch monarchy—and like France and the USA born of the Age of Enlightenment—was the short-lived

Wedged between the Dutch republic and the Dutch monarchy—and like France and the USA born of the Age of Enlightenment—was the short-lived  The Court of Appeal in Den Bosch has recently ruled that the public prosecutor must start a case against broadcaster BNN

The Court of Appeal in Den Bosch has recently ruled that the public prosecutor must start a case against broadcaster BNN